Trusted M&A Advisors for Privately Held Businesses

Empowering entrepreneurs through clarity, strategy, and successful exits—one deal at a time.

Aligned Outcomes

We believe every successful deal begins with aligned goals between buyers and sellers. We focus on transparency and strategic fit—not just transactions.

Results With Integrity

We’re here to deliver outcomes you can be proud of. Confidentiality, professionalism, and trust drive every step of our process.

People Over Process

We don’t treat business sales like checklists. We build relationships, understand motivations, and tailor each engagement to the human side of the deal.

Regional Roots, National Reach

From Boise to Bozeman, Salt Lake to Jackson Hole—we know the unique dynamics of the Mountain West, while marketing your business to a nationwide buyer pool.

National Reach, Local Expertise

Connecting Entrepreneurs with Opportunities Across North America

Our Approach

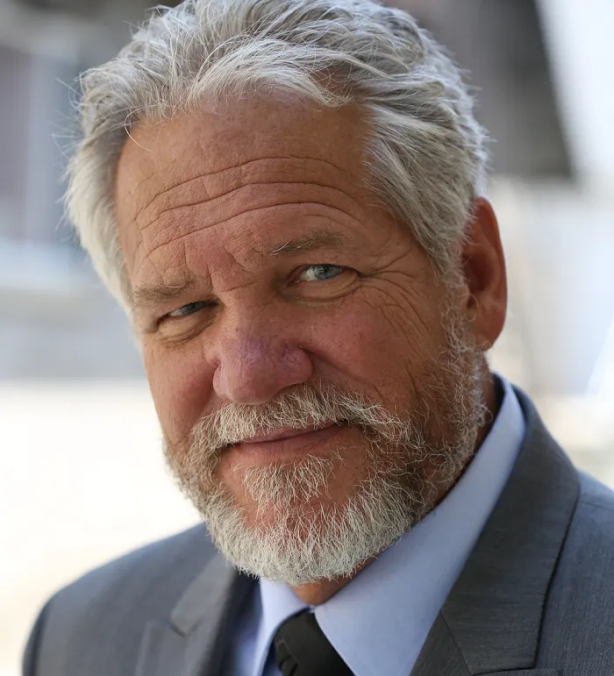

Our team

Please click on team member's photo to view their personal web page and see contact details

Find a Local Advisor

We specialize in aligning seller and buyer goals to create smooth, win-win transactions. More than just advisors, we’re strategic matchmakers with expert dealmakers located throughout Idaho, Utah, Montana, and Wyoming—ready to guide you at every step.